Dr Hake, Professor of Economics at Catawba College, delivers an informative and entertaining view on current inflation with an insightful dip into economics. If you missed him in action, here’s your chance to catch him on video and follow along with his helpful notes. https://youtu.be/PddT0vTtI4k You’ll have some new answers to “… but what about the economy?”

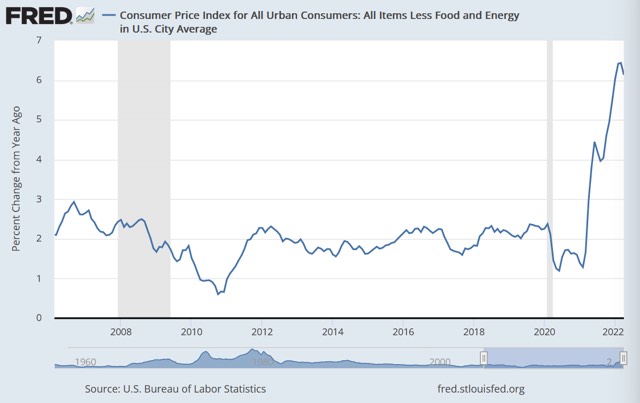

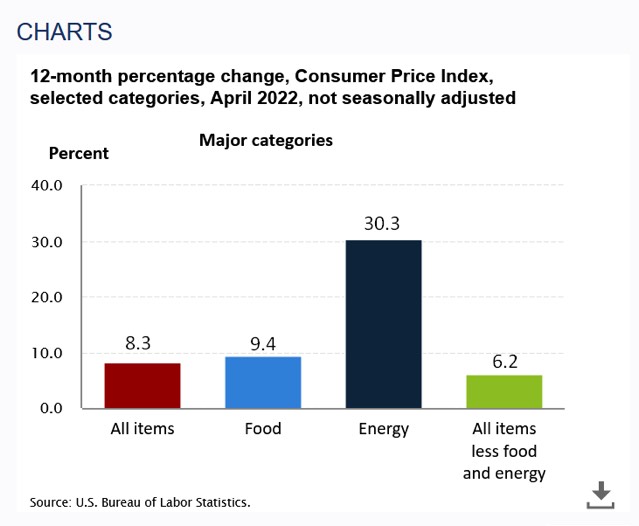

Inflation is usually reported as an annual rate, while data is collected monthly. Headline inflation includes all sectors, but given the volatility of food and energy prices, you will also see a core inflation rate which excludes food and energy.

Both headline and core inflation have been rising since April 2021, when they surpassed the 2.0% inflation target of the Federal Reserve. Data for April 2022 show a monthly decline in both core and headline inflation.

In our theory of market economies, the average price level (inflation rate) is determined by the interaction of aggregate supply and aggregate demand. Too much demand or too little supply will cause inflation.

An observation from John Maynard Keynes: “In the situation of excess capacity, it is possible to increase aggregate demand, increase the equilibrium level of output, without causing inflation.” Want to improve economic growth?

Increase aggregate demand. Solution most famously applied by Franklin Delano Roosevelt in the New Deal 1933-1937.

An observation from Milton Friedman: “Inflation is everywhere and always a monetary phenomenon. The level of aggregate demand is determined by the level of money supply.” Want to reduce inflation? Cut the money supply.

Solution most famously applied by Paul Volker in the monetarist experiment 1979-1982.

Since the 2000 stock market bubble and the 2008 real estate bubble the US economy has utilized both

1) loose monetary policy (Greenspan, Bernanke, Yellen, Paulson) to lower interest rates, inflate the stock and

bond market, and hopefully keep the economy from slipping into a deflationary episode.

2) Large deficit fiscal policy (Bush, Obama, Trump, Biden) to stimulate aggregate demand, provide tax cuts, and encourage business spending (also a part of aggregate demand).

For 20 years, we have been attempting to create more inflation. It is better than deflation.

Additional factors contributing to Inflation in 2021-2022:

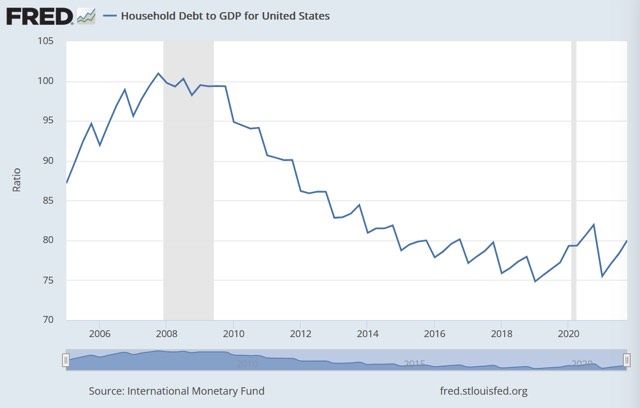

Demand Pull inflation: Too much demand chasing too few goods. COVID relief package of $1.9 trillion. Excessively loose monetary policy (low interest rates and quantitative easing) since 2008.

Cost push inflation: Rising wages and wage pressure since COVID pandemic has led workers to expect greater compensation for new risks. A risk of death premium.

Supply Chain issues: Too little supply for current demand. Supply-chain disruptions caused by COVID pandemic, Ukraine/Russian conflict and impact on food and energy markets.

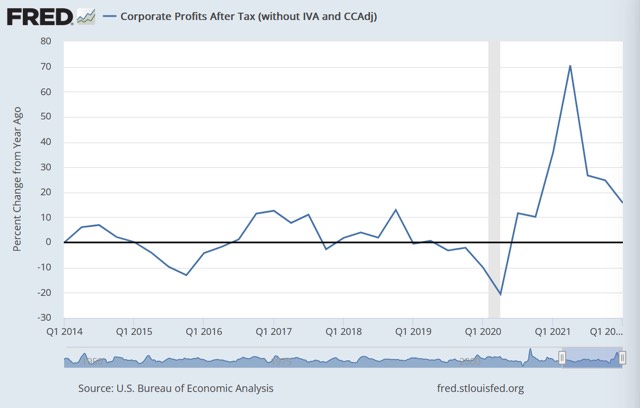

Corporate power: rising profit margins and the influence of oligopolistic firms to set prices.

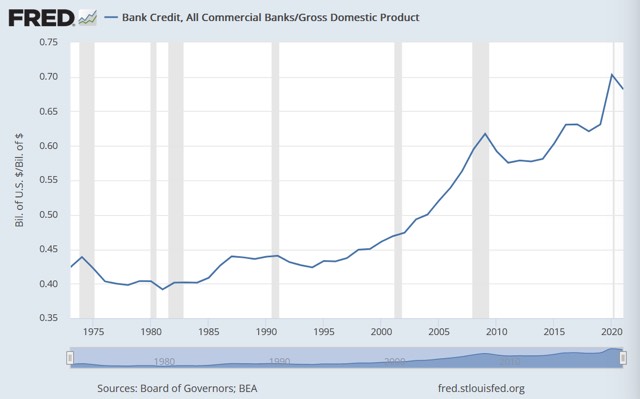

The leverage cycle: the availability of credit (borrowing) rather than more income or money supply can cause rising demand. The leverage cycle drives the business cycle and changes prices. Speculation in specific commodities or markets.

Current macroeconomic policy to lower inflation has focused on reducing aggregate demand. It is the Milton Friedman solution. “We are all monetarists now.”

The Federal Reserve has raised the federal funds target rate from .25 to 1 percent – .25 percent in March and .50 percent in May – to reduce consumer spending, slow down economic growth, and reduce inflation. By raising interest rates, the Federal Reserve can slow consumer and business demand for interest sensitive goods.

This policy works, but it also causes recession. So, we discuss the idea of a ‘soft landing’ to lower inflation without causing a recession.

Evidence that inflation is not caused solely by excess aggregate demand or the Biden COVID relief package:

Prior monetary policy, Supply chain disruptions, shortages of specific inputs, global port congestion, rising profit margins

Inflation rising outside of the United States, not just a US phenomenon. EU headline inflation rate also 8.0%